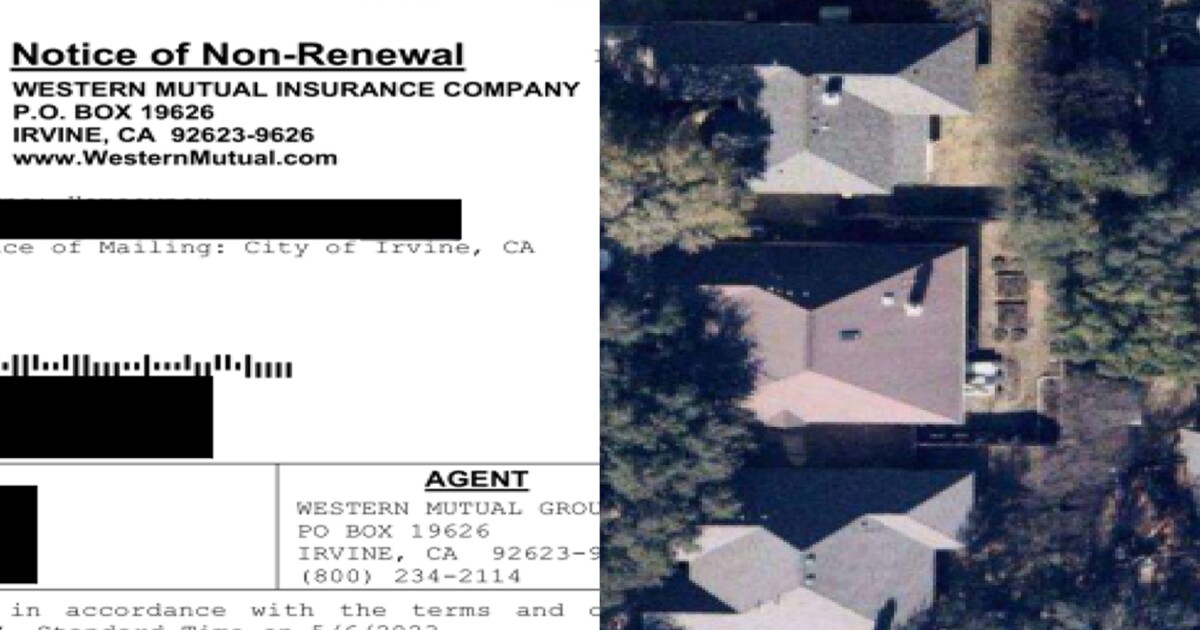

At least one company uses computer models to inspect these photos and flag moldy roofs, askew tree branches and missing shingles. Insurers then notify homeowners their policies may not be renewed.

While it’s unclear how many homes are under surveillance, the number could be massive — and growing. One aerial imaging technology company common among insurers says it has eyes on 99.6% of the country’s population.

Faced with more extreme weather and costlier damage to homes, insurers are increasingly relying on new technologies like aerial images to evaluate policies — and in some cases, to forgo risk. Between 2020 and 2023, the rate at which insurers in Texas chose to not renew home insurance policies almost doubled.

The rate on our house in the Houston Metroplex has more than doubled within the last year despite no historical damage or flooding since 1980.

The broader market in this region is not in good shape though since developers keep building homes in riskier areas and taking away natural grasslands and forests that can accept water.

We were shopping for insurance on some houses we were looking at and got quoted $16k/year on an average size/cost house out in Missouri City. This area is rapidly going the way of Florida/California with insurers pulling out or dramatically rasing rates. Our insurance broker specifically said companies have pulled out of Fort Bend County citing the risk.

While governments are in denial of climate change happening, insurance companies aren’t. They’re hedging their bets early.

The hour is later than you think. The climate is already changing. The 1.5C threshold has been left behind.

Free market climate change works both on the cause and effect side.